private reit tax advantages

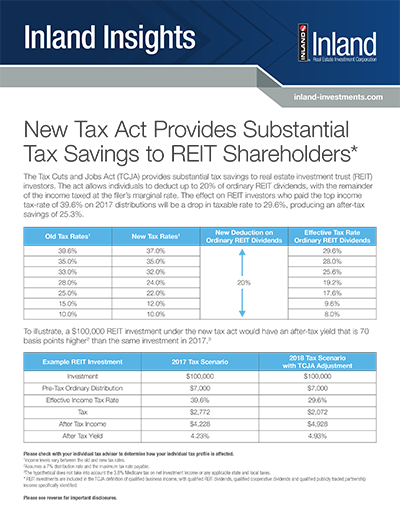

Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors but now also US. The 199A tax deduction is spurring interest for real estate investors to move their properties into REITs in order to qualify for the 20 percent deduction.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

In addition REITs have their own tax-advantages classifying their returns as a return of capital.

. The second primary advantage is long-term capital gains. Ad How these allow ample opportunity for investors to diversify a portfolio with Real Estate. Learn more and become a real estate investor today.

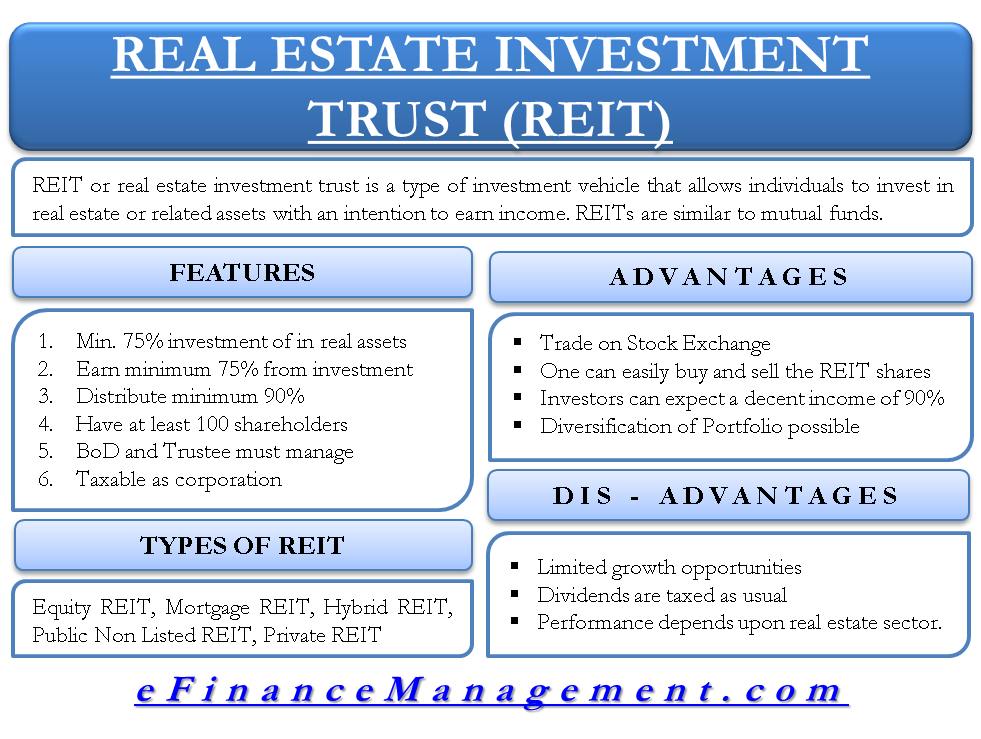

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Have at least 100 shareholders. A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. The list below summarizes a few of the main advantages. Earn at least 75 of its income from rental income or other real estate activities.

Entities qualifying for REIT status under the tax code receive preferential tax treatment. Monomoy Properties REIT LLC is a private Real Estate Investment Trust that was formed in 2014 with the purpose of building an industry leading single-tenant industrial portfolio specializing in. Typically used to avoid UBTI or FIRPTA tax.

For tax-exempt investors dividends from a REIT typically are exempt from UBTI. Tax benefits of REITs. Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but.

Private REITs can also pass through a myriad of other tax-advantaged situations like Opportunity Zones and 1031 Exchanges to name a few. Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation. If those werent enough reasons to consider investing in a REIT one should also consider the diversification advantages that a REIT can offer such as multiple tenants multiple properties a diverse tenant mix and geographic diversity.

Moreover there are a number of situations where a private REIT can be used to obtain tax advantages. Be no more than 50 owned by five or fewer individuals. Shares are not traded.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Specifically REIT profits pass through untaxed to shareholders via dividends. Note however that the conversion of an OP unit to a REIT share is a taxable event.

To classify as a REIT the company must. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. McCann Esq and Philip S.

Understanding the Tax Benefits of REITs. Deep industry experience unique model. Trade shares in commercial real estate without lockups no more holding periods.

In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. A notable advantage of REITs is the ability to characterize a portion of distributions that would otherwise be treated as ordinary income as ROC due to real estate-related factors such as depreciation and amortization. Private REITs Why use a private REIT instead of an LP or LLC.

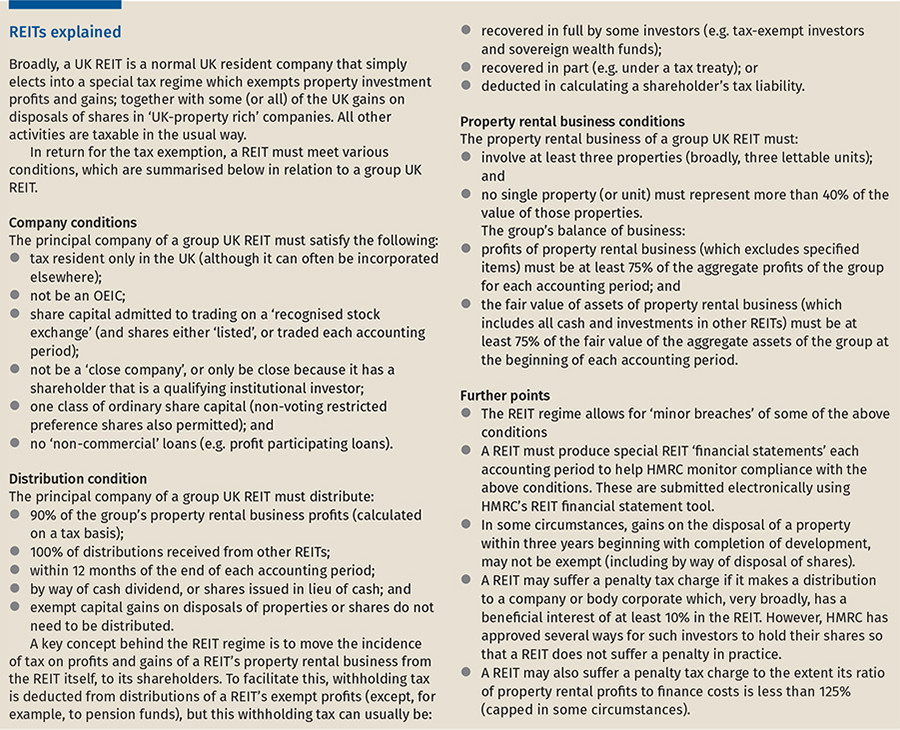

If you hold an asset for a year or more you will pay long-term capital gains tax which is much lower than ordinary income. Get your free copy of The Definitive Guide to Retirement Income. Property rental business Property rental business profits and gains are tax-exempt within the REIT itself.

Ad Analyze investments via suite of research tools offering property details data more. Tax advantage of REITs. Heres my two cents on private REITs.

REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. ROC distributions are tax deferred until redemption at which time they give rise to capital gain.

The income generated by REITs is not taxed on the corporate level and is instead taxed only on the individual shareholder level. This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed.

This is one of the most significant tax advantages of investing in a REIT. Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in. Investments in an LP or LLC are more likely to result in UBTI due to debt financing.

The private equity firm passes all tax benefits on to its investors including depreciation and capital recapitalization while REIT payouts are taxed at an investors higher ordinary income. REITs as a Blocker of Unrelated Business Taxable Income UBTI and Effectively Connected Income ECI with a US. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units convertible on a one-to-one basis into shares in the REIT.

Because they arent as heavily regulated private equity firms can be nimble and flexible in their investment strategy giving them the freedom to pursue profitable deals where available. REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment entity reduces the number of entities needed in the structure. Advantages to foreign investors.

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1 million excluding primary residence or with income exceeding 200000 over two prior two years 300000 with a spouse. Have 75 of assets in real estate. There are a couple of reasons that partnerships are becoming more interested in REITs.

In its simplest tax form a REIT functions like a hybrid of the two and provides the best of both worlds. Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

This inevitably leads to a better potential for higher returns private REITS are able to consistently pay out greater dividends than public REITs. Some examples of the benefits of private REITs are set forth below. A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status.

Nevertheless numerous private REITs have been set up as so called incubator REITs in anticipation of taking the fledgling REIT public in the future. A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings. Ive evaluated many private REITs and Id.

Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency. Ordinary dividends from a REIT are not subject to foreign withholding.

Guide To Reits Reit Tax Advantages More

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Pin By Jessica Greene On Love Love Finance Investing Finance Investing

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Your Wealth Secret An Automatic Systematic Accumulation And Investment Program Ezmart4u Investing Systematic Investment Plan Creating Wealth

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

We Re Thrilled To Have Entertainment Financial As An Exhibitor For The 2012 Business Showcase Entertaining Allianz Logo Business

Reit Or Real Estate Investment Trust All You Need To Know

Taxation Of Reits Ringing In The Changes

Guide To Reits Reit Tax Advantages More

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Sec 199a And Subchapter M Rics Vs Reits

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business