pa inheritance tax family exemption

If the deceaseds farm falls into a specific category the land can pass free of the Pennsylvania Inheritance Tax. To qualify for the.

![]()

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

Family Farm Exemption.

. 0 Inheritances to a spouse Inheritances to a parent from a child 21 or under. To understand the significance of this most recent change its helpful to review the history of Pennsylvanias inheritance tax law. Act 85 of 2012 recently enacted by the Pennsylvania Legislature will allow farmers to pass their family farms to future generations free of Pennsylvania Inheritance Tax.

Pay the PA inheritance tax early. The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust. What is the family exemption for inheritance tax.

The spouse of any decedent dying domiciled in the Commonwealth and if there be no spouse or if he has forfeited his rights then such children. 15 Inheritances for any other either. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

There is a 12 tax on transfers to siblings and a 15 tax on transfers to any other heir with the exception of charitable organizations exempt institutions and government. Therefore if you and your spouse own all of your property jointly upon death of the first spouse there will be no Pennsylvania inheritance tax. Qualifying for the Family-Owned Business Exemption from Pennsylvania Inheritance Tax.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural. The farmland must transfer from the.

Pennsylvanias Governor signed a new law which went into effect on July 9 2013. The family exemption is in the nature of a property right and was originally based on the principle that in no event should the family be wholly deprived of support. 15 percent on transfers.

Family Owned Business Pennsylvania Tax Exemption The family owned business tax exemption can have a big impact on your Pennsylvania inheritence taxes. 12 percent on transfers to siblings. The family exemption is a right given to specific individuals to retain or claim certain types of.

Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the. Are fully deductible for Pennsylvania Inheritance Tax purposes. 12 Inheritances for siblings.

The family exemption is 3500. Traditionally the Pennsylvania inheritance tax had a very. 45 percent on transfers to direct descendants and lineal heirs.

This law is significant in the area of PA Wills and Trusts as it allows an inheritance tax exemption for the. Beginning July 1 2013 the transfer at death of certain family owned business. If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount.

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or. For decedents dying after Jan. WHAT IS THE FAMILY EXEMPTION AND HOW MUCH CAN BE CLAIMED.

Convert your IRA to a Roth. Act 52 adds Section 2111t to the Pennsylvania Tax Reform Code to exempt the following transfers at death from PA inheritance tax. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim.

Secondly certain property is exempt from the tax altogether. The rates for Pennsylvania inheritance tax are as follows. 1 A transfer of a qualified family-owned.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Farmland is exempt from inheritance tax as long as the land is. Up to 25 cash back The Pennsylvania legislature has carved out inheritance tax exceptions for certain kinds of property.

The most important exemption is for property that is owned jointly by a husband and wife. Pennsylvania Inheritance Tax. 45 Inheritances for children Inheritances for lineal heirs.

Digitalisierte Sammlungen Der Staatsbibliothek Zu Berlin Werkansicht Bulandshahr A Gazetteer Ppn667090118 Phys 0098 Fulltext Endless

Do I Have To Pay Taxes When I Inherit Money

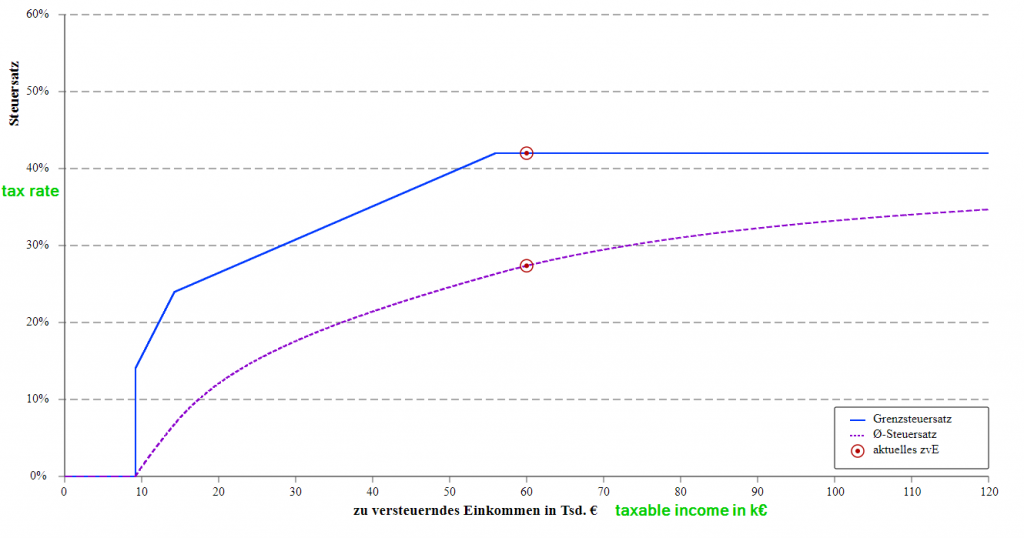

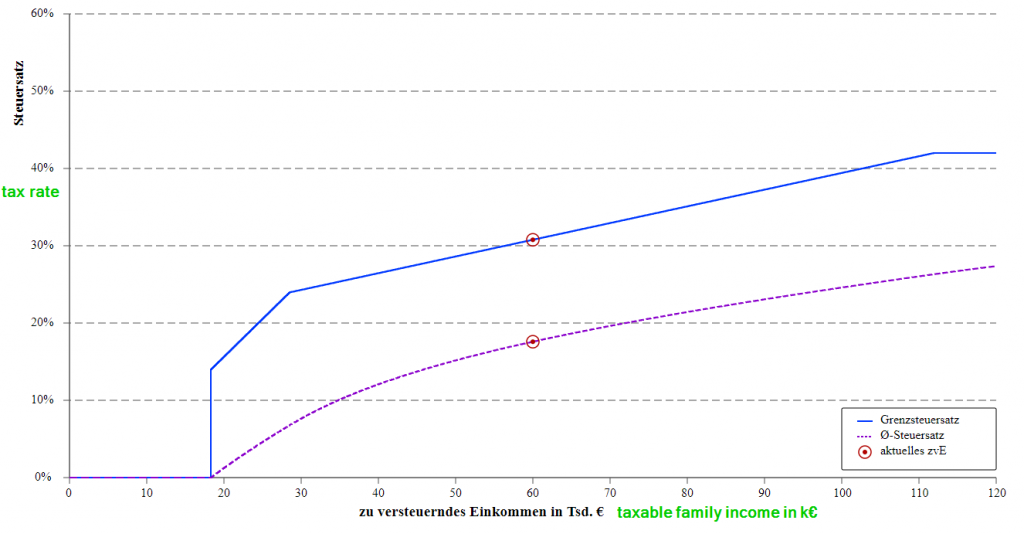

The Inheritance And Gift Tax In Germany Reform Potentials For Tax Revenue Efficiency And Distribution Public Sector Economics

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

New Inheritance Tax Exemption For Family Businesses In Pennsylvania Inheritance Tax Business Tax Estate Administration

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

Pin On Estate Planning Administration

Florida Estate Tax Rules On Estate Inheritance Taxes

The New German Inheritance And Gift Tax Act Finally Meeting The Constitutional Principles

Sargassum Triggerfish Photo Nurc Uncw And Noaa Fgbnms Estate Planning Estate Administration Fish Pet

Faq German Tax System Steuerkanzlei Pfleger

Faq German Tax System Steuerkanzlei Pfleger

New Inheritance Tax Exemption For Family Businesses In Pennsylvania Inheritance Tax Business Tax Estate Administration

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Digitalisierte Sammlungen Der Staatsbibliothek Zu Berlin Werkansicht Political And Statistical Account Of The British Settlements In The Straits Of Malacca Viz Pinang Malacca And Singapore Ppn671528505 Phys 0274 Fulltext Endless

The New German Inheritance And Gift Tax Act Finally Meeting The Constitutional Principles

The Inheritance And Gift Tax In Germany Reform Potentials For Tax Revenue Efficiency And Distribution Public Sector Economics